Khalifa Fund is the largest enterprise development entity in the UAE, making a significant positive impact on the SME sector through its funding and practical support.

The UAE’s entrepreneurial ecosystem is crucial for the nation’s economic growth. By partnering with Khalifa Fund, SME growth is accelerated, and commercial success is strategically achieved.

Get FundedFunding Products

Khalifa Fund has designed several funding products to support the growth and success of SMEs.

-

Financing Business - Operating Capital

Maximum Loan: Up to AED 600,000

Repayment period: 12 months.

Scale-up Funding

-

Financing Fixed Assets - Vehicles and Logistics

Maximum Loan: Up to AED 1 million or 80% of new company assets/vehicles cost

Repayment period: 36 months.

Scale-up Funding

-

Financing Fixed Assets - Equipment and Machinery

Maximum Loan: Up to AED 1 million or 80% of new equipment/machinery cost.

Repayment period: 36 months.

Scale-up Funding

-

Financing Invoice Financing - Receivables

Maximum Funding: Up to AED 1 million or 80% of the discounted bills.

Scale-up Funding

-

Advance Payment Guarantee (APG)

Maximum Loan: Up to AED 1 million or 70% of the APG.

Repayment period: As per the contract and doesn’t exceed 36 monthsScale-up Funding

-

Financing - E-commerce Inventory

Maximum Loan: Up to AED 1 million or 80% of the finished goods.

Repayment period: 12 months.Scale-up Funding

-

Financing - Agri-Tech

Maximum Loan: Up to AED 2 million

Repayment period: 36 to 48 months.Scale-up Funding

-

Microfinance Loan

Maximum Loan: Up to AED 500,000 or 80% of total cost

Repayment period: 60 months.

Start-up Funding

-

Small Loan

Maximum Loan: Up to AED 2 million or 80% of total cost.

Repayment period: 72 months.Start-up Funding

-

Expansion Loan

Maximum Loan: Up to AED 3 million or 80% of total cost.

Repayment period: 84 months.Start-up Funding

-

Pack House and Infrastructure Development

Maximum Loan: Up to AED 250,000 or 90% of the total cost.

Repayment period: 36 months.

Start-up Funding

-

Net House Development Fund

Maximum Loan: Up to AED 400,000 or 90% of the total cost.

Repayment period: 60 monthsStart-up Funding

-

Water Management System Enhancement Fund

Maximum Loan: Up to AED 150,000 or 90% of the total cost.

Repayment period: 48 months.Start-up Funding

Get Funded

Khalifa Fund offers medium-term, interest-free loans to Emirati entrepreneurs that will support their business potential and growth. Emirati entrepreneurs aged 21-60 with operational businesses in Abu Dhabi and Western Region can apply. Funding is available according to an eligibility criteria for businesses in Healthcare, Education, Agriculture, ICT, Tourism, and Manufacturing industries.

Check your Eligibility

Designed to help entrepreneurs assess their eligibility for Khalifa Fund programs, this user-friendly interface lets you input key financial details such as funding amount, repayment period, monthly salary, net cash flow and profit for the last two years, rental income, credit card limit, and bank instalments.

Click “Calculate Eligibility” to begin your business growth journey with Khalifa Fund.

Calculations provide a provisional estimate of available funds. Actual eligibility may vary based on additional factors and final approvals. Our calculator is regularly updated for accuracy.

Assess your eligibility today!

Calculate Eligibility

Post-Funding Services

Beyond funding assistance, Khalifa Fund provides a comprehensive range of post-funding services to ensure that we support your business growth and success – every step of the way.

Disburse an Approved Loan

Initiate the disbursement process for your approved loan amount, allowing you to launch your project on time and with strategic efficiency.

Release Collateral for Funded Project Assets

Take the first step towards releasing collateral linked to your funded project assets, facilitating the growth and progression of your venture.

Amend an Existing Loan

Adjust the terms of your existing loan to better suit the evolving needs of your business – ensures financial alignment and flexibility.

Reallocation of Loan Disbursement

Maximise the impact of your funding by strategically reallocating your loan disbursement to enhance project execution and optimise resource utilisation.

Request for Loan Top-Up

Access additional funding to accelerate the growth of your project or address unexpected challenges. Continued momentum and resilience during the entrepreneurial journey is supported.

Request to Cancel Loan

Explore easy ways to cancel your loan if circumstances necessitate.

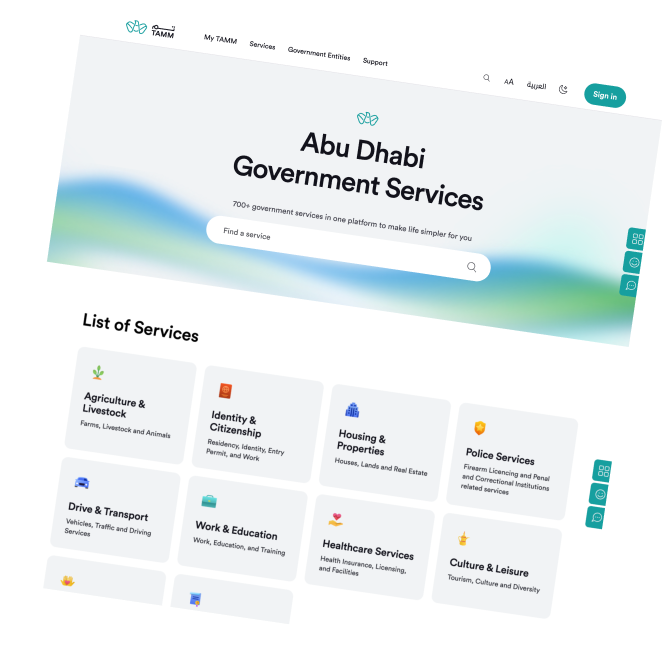

CTA to TAMM

Entrepreneurs who are looking for funding or financial support solutions, learn more and submit your application to Khalifa Fund care of the Abu Dhabi Government Services platform, TAMM.

Get FundedFrequently Asked Questions

Discover answers to common questions about applying for funding, available services, evaluation criteria, and more. If you have additional questions, feel free to contact us directly.